Prone to massive gains or losses, for better or worse, my portfolio is exclusively comprised of biotech and completely volatile in nature. biotech investing is like riding a rollercoaster. One minute you're going down in flames, your stock is tanking 50% down on news of a FDA regulatory approval snafu, another minute you're riding sky high as your stock is rocketing up 100% for curing alzheimers. 30 years from now, my kids will either say I was a reckless speculator who gambled his life savings away or I was the most amazing investor who was able to retire young from architecture. Only time will tell.

For those readers who are unaware of the biotech investing game, for regulatory approval a drug has to pass 3 clinical phases. In phase 1 the drug is administered to about 100 healthy patients. Doctors determine whether the drug is safe and not killing people. In phase 2, the drug is administered to 300 sick people and compared to placebo effects. If a drug is deemed to have a therapeutic effect, it continues onto phase 3 in which efficacy and safety data is collected for 3000 patients. historically 70% of drugs pass phase 1, 33% pass phase 2 and 25% pass phase 3.... so mathematically, biotech is hard -- a novel drug in development has about 5% chance of approval.

Currently, I’m making the largest investment wager of my life on Novaxax (NVAX), a biotech company that has endured several phase 3 failures over the course of its 30 year life with no approved drug to its name. I lost $5000 on one of those NVAX phase 3 failures for a flu vaccine many years ago, so I was hesitant to invest in NVAX again. kind of like how a victim of domestic abuse is hesitant to return to the trailer park. But as I kept watching the stock, it kept rising. From $4 all the way up to $120 in the past 6 months. i hesitated buying a shitload of cheap options when the stock was $50, and lost out on thousands of profits, so i've decided to go all in now at the biotech poker table.

With American millennials partying sans mask and spreading corona, the covid situation is basically raging like a dumpster fire in America. the trump administration is pouring money into biotech for salvation and hopes of re-election. The more desperate America and trump gets, the more money it spends on corona vaccine development. A couple weeks ago, the US pledged a whopping $1.6 billion on NVAX for its corona virus vaccine development.... this came after Bill Gates’ CEPI foundation (Coalition for Epidemic Preparedness) pledged $400 million and RA Capital hedge fund headed by Harvard trained virologist peter kolchinsky invested $200 million (earning $240 million in the past month on NVAX’s rise). Based on a hunch that these 3 players have seen preliminary data to warrant these large pledges of cash, I decided to stray from my disciplined investment system and actually research and read about what the company does, and allocate my life savings on NVAX stock before their phase 1 readout is publicized at the end of July.

Relieved he didn’t harm his trial participant, in phase 2, he injected Phipps with small pox material. No disease followed. The boy was later challenged with small pox material and again showed no sign of infection.

In phase 3, Jenner successfully tested his hypothesis on 23 additional subjects. Jenner continued his research and reported it to the Royal Society, which did not publish the initial paper. In his papers, Jenner named vaccine after vaccus, or the Latin word for cow to honor the source of the cure. After revisions and further investigations, he published his findings on the 23 cases, including his 11 months old son Robert. The medical establishment in England deliberated at length over his findings before accepting them. Eventually, vaccination was accepted, and in 1840 England started providing vaccination using cowpox free of charge.

Jenner’s success was soon adopted all over the world. Napoleon, who at the time was at war with Britain, had all his French troops vaccinated, awarded Jenner a medal, and at the request of Jenner, he released two English prisoners of war and permitted their return home. Napoleon remarked he could not "refuse anything to one of the greatest benefactors of mankind". It is estimated that with his vaccine, Jenner saved 300 million lives.

Like NVAX recent pledges of capital, he was granted money by the government to further his research. £10,000 in 1802 for his work on vaccination. In 1807, he was given another £20,000 after the Royal College of Physicians confirmed the widespread efficacy of vaccination.

A corona virus has a spike protein which it uses like a syringe to inject its RNA into a host cell to replicate. NVAX’s approach to attacking the corona virus is to introduce copies of the spike protein to the human body. This presentation of benign corona protein fragments induces an immune response by prompting the body to create antibodies for the spike protein that will bind actual invading corona spike proteins, and induce killer T cells to kill corona infected cells.

To accomplish this strategy, NVAX took the portion of the sequence of the corona virus that codes for its spike protein and inserted it into baculovirus to infect moths. The infected moths are like biological warehouses and create the recombinant protein spike in their bodies. infecting insect cells to produce proteins is a lot easier than growing protein producing cells in thermally regulated bioreactors. NVAX ‘harvests’ these spike proteins from moths and mixes it with an adjuvant. An adjuvant is a chemical substance that enhances a vaccine by presenting the antigen to the body for optimum recognition. Typical vaccines use alum as adjuvants. In NVAX’s case, they found using saponin (soap like substance) derived from the Quillaja Chilean soapbark tree is extremely effective. So far, in baboons, the moth produced spike protein in conjunction with the tree saponin adjuvant has resulted in antibody titers in the 10,000 range. In contrast, their nearest competitors’ (Moderna and AstraZeneca) antibody titers resulted in antibody counts around a paltry 100-150. In analyzing plasma from recovered corona patients, researchers have found the antibody count for spike proteins range up to 10,000 titer, so if NVAX is able to induce a 10,000 titer response in humans, one would assume they would have a potential working vaccine.

When asked about all their failures over the past 3 decades, and their failure to bring any vaccines to fruition, the CEO of NVAX replied they learned a lot from their setbacks with RSV, flu, Ebola, MERS to optimally design their covid vaccine and adjuvant.

NVAX already developed a second generation flu vaccine which utilizes the tree saponin and has been administered to elderly people safely and has met its goals in phase 3 studies. It is currently awaiting FDA approval. They believe their adjuvant will be similarly efficacious and safe with corona patients. To contrast safety profiles, in moderna’s recently completed phase 1 study, healthy patients suffered 103.8 degree fevers and assorted severe adverse effects from their vaccine. Additionally, no old people (>59 years old) were tested in Moderna’s phase 1.

With their work in MERS they knew it was important to target the spike protein as it is the least probable to mutate because it is needed evolutionarily for the virus to survive. From their Ebola work, they made partnerships with baboon labs in Oklahoma to test their vaccines on non-human primates. Through their RSV work they learned what assays to run to test antibody binding to recombinant proteins.

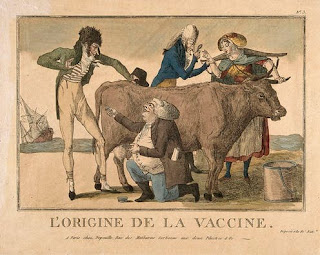

Since I graduated in biochemistry in 1996 (prior to embarking on architecture) much has changed in terms of biotechnology. Reading about biotech efforts today is like reading science fiction. who would’ve thought making recombinant spike proteins in moths and delivering them with Chilean tree bark saponins to immunize people from corona caused by bat eating chinese? one can imagine what Edward Jenner (father of immunology) would’ve thought about the advances in biotechnology. In his 18th century era, small pox had a death rate of 20% and would inflict unsightly blisters on victims. 30% of survivors had to deal with blindness.

Jenner noticed milkmaids were not susceptible to small pox. He postulated the pus in the blisters that milkmaids received from cowpox (a disease similar to smallpox, but much less virulent) protected them from smallpox.

On May 14, 1796 Jenner began his phase one trial. He scraped pus from cowpox blisters from the hands of Sarah Nelmes, a milkmaid who had caught cowpox from a cow called Blossom, whose hide now hangs on the wall of the St. George's Medical School library. He then inoculated James Phipps, an eight-year-old boy who was the son of Jenner's gardener. Phipps a fever and some uneasiness, but no full-blown infection.

|

| corona spike protein 3d structure |

|

| cabbage looper moth bioreactor |

|

| Quillaja Chilean soapbark tree adjuvant |

|

| titer comparison. NVAX on top |

When asked about all their failures over the past 3 decades, and their failure to bring any vaccines to fruition, the CEO of NVAX replied they learned a lot from their setbacks with RSV, flu, Ebola, MERS to optimally design their covid vaccine and adjuvant.

NVAX already developed a second generation flu vaccine which utilizes the tree saponin and has been administered to elderly people safely and has met its goals in phase 3 studies. It is currently awaiting FDA approval. They believe their adjuvant will be similarly efficacious and safe with corona patients. To contrast safety profiles, in moderna’s recently completed phase 1 study, healthy patients suffered 103.8 degree fevers and assorted severe adverse effects from their vaccine. Additionally, no old people (>59 years old) were tested in Moderna’s phase 1.

With their work in MERS they knew it was important to target the spike protein as it is the least probable to mutate because it is needed evolutionarily for the virus to survive. From their Ebola work, they made partnerships with baboon labs in Oklahoma to test their vaccines on non-human primates. Through their RSV work they learned what assays to run to test antibody binding to recombinant proteins.

Since I graduated in biochemistry in 1996 (prior to embarking on architecture) much has changed in terms of biotechnology. Reading about biotech efforts today is like reading science fiction. who would’ve thought making recombinant spike proteins in moths and delivering them with Chilean tree bark saponins to immunize people from corona caused by bat eating chinese? one can imagine what Edward Jenner (father of immunology) would’ve thought about the advances in biotechnology. In his 18th century era, small pox had a death rate of 20% and would inflict unsightly blisters on victims. 30% of survivors had to deal with blindness.

Jenner noticed milkmaids were not susceptible to small pox. He postulated the pus in the blisters that milkmaids received from cowpox (a disease similar to smallpox, but much less virulent) protected them from smallpox.

On May 14, 1796 Jenner began his phase one trial. He scraped pus from cowpox blisters from the hands of Sarah Nelmes, a milkmaid who had caught cowpox from a cow called Blossom, whose hide now hangs on the wall of the St. George's Medical School library. He then inoculated James Phipps, an eight-year-old boy who was the son of Jenner's gardener. Phipps a fever and some uneasiness, but no full-blown infection.

|

| cow pox on udder |

|

| small pox vaccinated boy on right |

Relieved he didn’t harm his trial participant, in phase 2, he injected Phipps with small pox material. No disease followed. The boy was later challenged with small pox material and again showed no sign of infection.

In phase 3, Jenner successfully tested his hypothesis on 23 additional subjects. Jenner continued his research and reported it to the Royal Society, which did not publish the initial paper. In his papers, Jenner named vaccine after vaccus, or the Latin word for cow to honor the source of the cure. After revisions and further investigations, he published his findings on the 23 cases, including his 11 months old son Robert. The medical establishment in England deliberated at length over his findings before accepting them. Eventually, vaccination was accepted, and in 1840 England started providing vaccination using cowpox free of charge.

Jenner’s success was soon adopted all over the world. Napoleon, who at the time was at war with Britain, had all his French troops vaccinated, awarded Jenner a medal, and at the request of Jenner, he released two English prisoners of war and permitted their return home. Napoleon remarked he could not "refuse anything to one of the greatest benefactors of mankind". It is estimated that with his vaccine, Jenner saved 300 million lives.

Like NVAX recent pledges of capital, he was granted money by the government to further his research. £10,000 in 1802 for his work on vaccination. In 1807, he was given another £20,000 after the Royal College of Physicians confirmed the widespread efficacy of vaccination.

No comments:

Post a Comment